Filing a FAFSA (Free Application for Federal Student Aid) is an important step when preparing for college. These tips can make filing easier for financial assistance.

If you or someone in your household planning to go to college, you've probably heard of FAFSA, or Free Application for Federal Student Aid.

is administered by the FAFSA Federal Student Aid, an office of the US Department of Education. This office provides more than $ 150 billion in federal grants, loans and fund work-study to post-secondary students each year

Here are 10 tips to keep in mind when filing a FAFSA :.

1. Complete a FAFSA and apply for financial aid, even if you think you will not qualify

Think your family income is too high for federal student aid? You might be surprised.

If the student attends a public college, the family may be able to make up to $ 80,000 per year and still receive help. If the student attends a private college, however, the family income may be up to twice that amount, and the student can still receive assistance.

Another good reason to apply, even if you do not you think'll qualify, is that you must complete the Free Application for Federal Student Aid (FAFSA) prior to applying for many other forms of financial aid, including grants college or university.

2. Complete the online form

The easiest way and fastest to file a FAFSA is online at the Federal Student Aid website here.

3. Have your handy information

- Social Security Number or Alien Registration Number (if you are not a US citizen).

- tax returns on the recent federal income, W-2 forms and other proof of income such as pay stubs.

- Bank and brokerage statements and records of all other investments.

- Acts of non-taxable income, such as municipal bonds.

You may also need this information for a step-parent if the student lives with a parent and a stepparent.

4. Do not delay

Allow enough time to complete the application. You will need a lot of information, some of which you might need to get other people. You must complete the FAFSA as close to January 1 as possible to ensure you comply with all federal and state deadlines for financial aid.

5. Get a Federal Student Aid PIN

You will need a PIN (personal identification number) to sign the FAFSA electronically. Visit pin.ed.gov to obtain a PIN.

6. Be sure you know who is considered the parent of the child

If the legal parents of the student are married or not married and live together, using information financial for both parents. This is true if the parents are of the same sex or gender.

If the parent of the student is widowed or never married, use of financial information of that parent.

If the parents are divorced or separated and not living together, use the information for the parent with whom the student lived the most during the past 12 months. If the student lived with each parent for the same amount of time, use the information for the parent who provided more financial support.

7. Estimate numbers if you are filing a FAFSA before completing your tax return on income

If you have not completed your tax return for previous year, do not let that stop you. You can always update the numbers if you need later.

8. Submit a FAFSA each year, the student must be considered financial assistance

Yes, you get to do it again - and again. You will not be starting from scratch, however. You just make adjustments each year.

9. Learn more about the different types of student aid offered by the Ministry of Education of the United States

The subsidies are only one type of aid to students. Grants must be repaid. The four types of federal scholarships are:

Federal Grants Pell Up to $ 5,550 (2014-2015 years) is awarded to undergraduate students based on financial need and other factors

..additional federal Educational Opportunity Grants (FSEOG). These grants are awarded to students with exceptional financial need, depending on availability of funds at the college.

Teacher Education Assistance for College and Higher Education (TEACH) Grant. This assistance is available for students who intend to teach in public or private schools that serve students from low-income families.

Iraq and Afghanistan Service Grant. These grants are for dependents of Canadian Forces members who have died as a result of military service in Iraq and Afghanistan.

FAFSA Application can also help a student get scholarships and student loans.

10. Get a jump start on the FAFSA using FAFSA the Summary Sheet TaxACT

print College Financial Aid Worksheet TaxACT includes all the tax information you must complete the FAFSA online at fafsa.ed.gov.

After entering your tax information in your TaxACT return, your financial aid College Leaf will be ready in the review tab.

How important do you think it is for a person to try graduated from college debt free

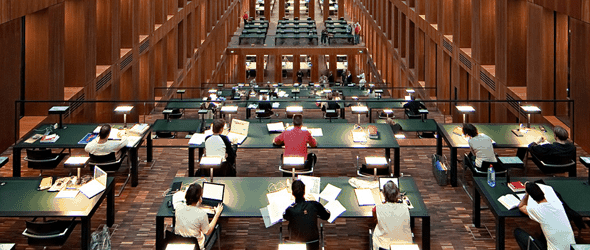

photo credit: 96dpi via photopin cc

0 Komentar