From time to time, we all need a "do more" - even when it comes to our tax returns. Fortunately, if you made a mistake on your return home or failed to claim a deduction or credit, the IRS has a solution. It is called Form 1040X, individual US Declaration amended tax return .

Filing an amended return does not have to be difficult. In addition, using TaxAct makes it even easier. If you are thinking of filing Form 1040X, here are some important points to remember.

Not another full tax return to make a correction.

If you filed your tax return and notice that you forgot a deduction or credit, your first instinct may be to send a new tax return and tell the IRS to ignore the 'former. But this is not the right answer.

Whether you've hit the button to e-file your return or dropped a paper copy by mail after you file your tax return on the initial income, which is considered your statement the applicable tax year.

You can not produce a complete tax return with all schedules and attachments once. You can make changes, but you can not start over.

Use Form 1040X to amend your return.

Instead of sending a new tax return, you must use Form 1040X to change any incorrect items you might have.

In addition, you may need to include updated versions of any forms or schedules that you originally included as Annex E additional income and loss if the changes you make have an impact.

Keep in mind, you should include the corrected forms or schedules with Form 1040X. Do not attach copies of any forms or schedules that have remained the same.

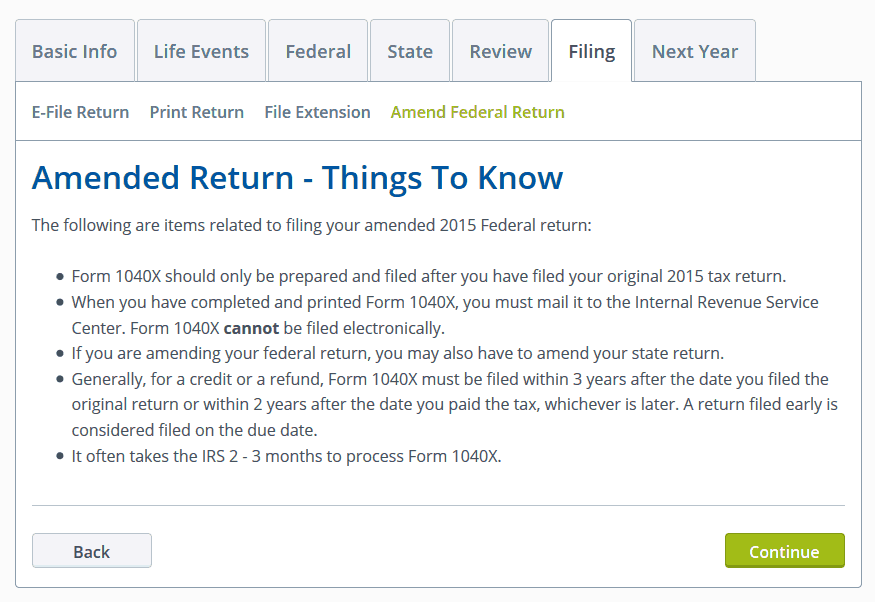

To file the Form 1040X using TaxAct, click Change the federal tab Back in principal Deposit and follow the Q & A interview to get your updates .

You can not send an e-file an amended return.

Unfortunately, the e-filing an amended return is not an option. You must print and mail Form 1040X, and all corrected forms and / or schedules.

If you received the product after 1099, and it includes the income tax withheld, be sure to attach this form as well.

You may have to file returns modified for more than a year.

Sometimes a change on the back of a year changes a part of the return of another year.

for example, some credits may be carried forward or back to other years. If the credit you request for changes in a year, you may need to modify another year too.

amending a federal return may mean filing a statement of the changed status.

State returns begin with information from your federal return. If you live in a state with an income tax state, you usually edit the two statements.

Be sure to contact your state department of revenue or a tax agency for information on what you need to do.

you have a limited time to edit and receive a refund.

Generally, you must complete Form 1040X within three years from the time you originally filed or within two years from the date you paid the tax, whichever is later.

If you need to change the return of more than one tax, you must complete a separate Form 1040X for each.

Some modified statements are not required.

There are some cases where the filing of an amended return is not necessary - even if you find small tax revenues a year later or remember a trip that should have been counted as mileage deductible. If the change will not affect the amount of tax you owe, it is not necessary to change your return.

Sometimes you do not need to file an amended return because the IRS sets your original return for you.

If you receive a letter stating that the IRS has found an error or made a change to your statement, and you accept the changes, you do not need to file an amended return.

However, you must always correct social security numbers if they are wrong, even if no other part of the statement is incorrect.

0 Komentar