Most taxpayers don, AOT have to worry about the new extra tax of 3.8% on the net investment income , or additional 0.9% Medicare tax .

the charges apply only to individuals (and estates and trusts) who have income on certain levels.

you usually won, AOT pay these taxes unless you make over $ 0,000 a year.

If you are married and you file a separate return, you can pay additional taxes after your income exceeds $ 125,000.

you never pay these taxes on the same income.

on net tax on investment income is based on investment income such as interest and dividends, while the more tax Medicare is levied on wages and other income.

tax on net investment income (NIIT)

From your statement in 2013 revenue, due when you file in 2014, you must pay an additional 3.8% on everything Aunet income investment, if your modified adjusted gross income is more than $ 0,000 ($ 250,000 if married filing jointly, or 125,000 $ if married filing separately).

investment income is usually money that you receive when your money or other investments working for you. This includes interest, dividends, capital gains, rental and royalty income, and non-qualified annuities.

Investment income does not include the gain from the sale of your home that you can exclude. However, if you gain from the sale of your home that you can not exclude, you may need tax net investment income on this amount.

Investment income does not include wages, unemployment benefits, social security benefits, alimony, tax-exempt interest, or self-employment income.

Before paying the additional tax on investment income, you can deduct certain expenses. This includes investments attributable interest expense, expense advisory and brokerage expenses related to rental income and royalty, and state and local taxes on income attributable to investment income.

TaxACT calculates the tax on net investment income for you on Form 1040 if the tax is applicable.

Do I have to pay tax on net investment income on my children's interests, AOS, dividends and capital gains that I report on my 1040 form?

you won, AOT pay this tax on your income children, AOS you exclude from taxable income due to the threshold amounts on Form 8814 or amounts attributable to Permanent Fund dividends Alaska.

However, you can pay the tax on net investment income over the remaining portion of your children from investment income, AOS if you report on your return.

because of this, if you are subject to tax on net investment income, you may want to file separate returns for your children.

should I include tax net investment income in my estimated tax payments?

Yes. You have to take the new tax into account when you make your quarterly estimated tax payments, or you may have to pay additional taxes, penalties and interest.

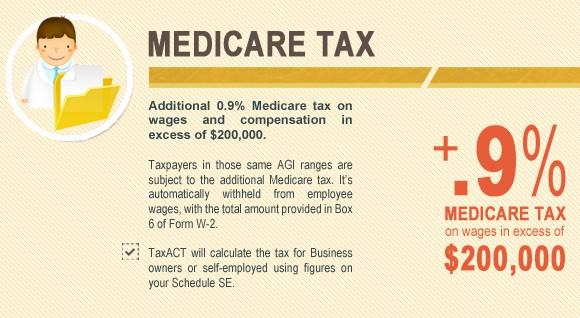

Additional fee Medicare

Another new tax for 2013 is the additional Medicare tax. You must pay this tax if your salary, compensation and employment income, and your spouse if a joint declaration, is over $ 0,000 ($ 250,000 if filing jointly, or $ 125,000 if the married filing separately).

If you earn a salary and you make more than $ 0,000 from an employer, your employer automatically retains the additional amount from your salary.

tax is 0.9% of your salary over $ 0,000.

The additional Medicare tax is different from the regular Medicare tax in one respect. Unlike regular Medicare tax, additional tax is calculated on your earned income only. It also takes your spouse, AOS income into account.

When TaxACT calculates the actual amount of the additional Medicare tax you owe, it may be different from the amount you deducted.

If you earn more than $ 0,000 in salaries and compensation, but paid by more than one employer or employer deducts the additional tax. You pay the additional Medicare tax with your other tax liability.

On the other hand, if you are married and you earn more than $ 0,000 but less than $ 250,000, and your spouse has no earned income, you can have the tax additional Medicare withheld.

However, if you file jointly, you should not tax because your total wages and compensation are not more than $ 250,000. Your total tax liability will be reduced by the amount of the additional Medicare tax you withheld.

How your tax rate on different investment types affect your investment decisions?

photo credit: WanderingtheWorld (www.LostManProject.com) via photopin cc

0 Komentar