Prepare financially for a Stay-at-Home Parent

In the hope of living on an income while you or your spouse remains home with the child (ren)?

This used to be commonplace but now many households include two working parents. Interestingly though, stay home parenting is mainly his work.

The number of US fathers who do not work outside of the house has reached 2 million in 2012, against 1.1 million in 1989 women, reports the Pew Research Center.

We talked to Bethany and Scott Palmer, founders of The Couple silver and co-author of books including "The personalities money Five," to get their advice on preparing financially for be a stay-at-home mother.

Rethinking expectations.

changing to a reduced income not only cash flow for discretionary spending, but also changes the family dynamic. "Set expectations regarding money, and set expectations around the house and time," Scott recommends.

Even if you shared the household responsibilities 50/50 before one spouse left the workforce, you may need to revise the division of labor in the future. "Assumptions can wreak havoc on your relationship," says Bethany

She suggests starting the conversation by saying. "Let us sit down and talk about the different categories of things that need to be covered." Then you could discuss where there is room to make budget cuts and how you will divide household chores.

practical life on one salary.

Before a spouse leaves the workforce, trying to live on the salary of the other spouse and save the rest.

This allows you to get used to living on less income (and build your savings) before you make the change, a process that usually takes about three months, according to Bethany.

If this arrangement is uncomfortable, consider alternatives such as offset time. When Palmers started a family, the couple created a schedule where one parent worked in the morning and the other afternoon of work.

Budget for fun too.

Initially, you might think to stay home with a baby would not be many additional costs attached. After all, no dry cleaning bills, no travel, no slats on the way to work. But Scott said it often not the case because stay-at-parents must still leave the house.

"Do not assume that things will get cheaper," he said. "You may think that things will become more expensive."

play groups, day movies baby and parent to music or yoga classes add structure to the week and keep parent and child entertained. of course, many options such as story time at the library or visits to parks and playgrounds can be the best friend of a parent on a budget.

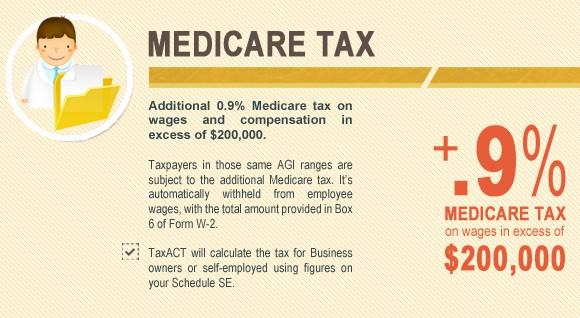

Continue saving for retirement.

When a parent leaves the labor force, he or she does has more power in 401 (k) withdrawals. But this does not diminish the need for retirement savings later in life.

the person with earned income can contribute up to 5500 $ annually (or $ 6.500 for more than 50) to an IRA spouse to spouse not working. that said, sometimes "it is logical that a joint to increase the amount they put in report the creation of a separate account, "said Bethany.

Either way, make sure that you continue to save for retirement as a couple, even when a person stops working. Tweet this

Think through estate planning.

Even if you do not have a huge area for someone to inherit, the Palmers encourage new parents to do some estate planning and to appoint a guardian for the children if something were happen to both parents.

Also buying a life insurance cover for both parents, a step that is often overlooked in the non-working spouse.

However, the loss of a parent who stays at home "could be just as expensive [as losing the income earner] because now you have custody of children and the activities that the person cares for to be financed "said Bethany.

have you adjusted to living on one income? How do you navigate this transition?