No matter how carefully you gather information for your tax return income, sometimes you find something after filing should have been included.

Perhaps you remember spent money on energy-saving equipment for which you should have received credit.

Or, you received a Form 1099-MISC and forgot to enter the income on your return.

These are cases where you might need to file an amended return.

How to file an amended return

once you have filed your original tax return, you do again and another complete statement.

you file your tax return filled with all schedules and attachments once. After that you must use IRS Form 1040X to change only the incorrect information.

For more inaccurate information appearing on the schedules or forms, such as Schedule C for sole proprietorship, you attach the forms or schedules to the corrected Form 1040X.

not attach copies of any forms or schedules that do not change.

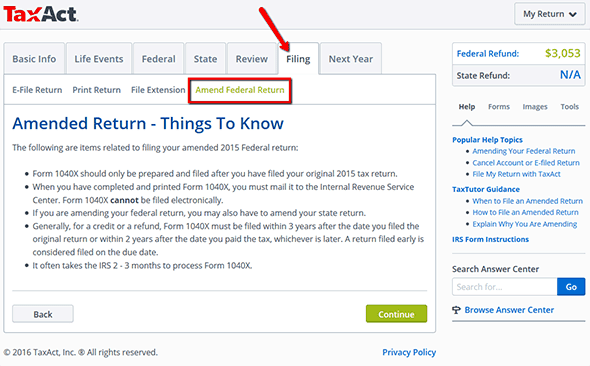

The best way to file an amended return using Form 1040X is used TaxAct. Click Change Federal Return on tab on the main Deposit

Note :. The IRS does not allow you to e-file your amended return. You must print and file by mail.

Your amended return can affect your return for other years

In some cases, changing the numbers on the back of a year can change the amount of credit you can receive in a year.

For example, the amount of total residential energy credit, you can take is limited, so if you change back to take more credit than a year, you may need to change as a year later in which you take the credit.

If you wear credits or deductions forward or back to other years, changing a year can change your credits or deductions for other tax years, as well.

remember your declaration of a state

do not forget to change your tax return state income. If you live in a state with an income tax state, you usually edit the two statements.

When not to file an amended return

In most cases, you don 't need to worry about changing your tax return if it does not change the bottom line on your tax return, or if the change is inconsequential. You do not want to change back whenever you find another $ 20 reception.

Make an amended return for important information, even if it does not change your tax debt, such as incorrect Social Security numbers for you, your spouse or your dependents.

If the IRS finds a mistake or change your return, the IRS is correct to make the change, you do not need to file Form 1040X. The IRS has already changed your return for you.

How long do I correct my mistakes?

You generally have three years to file the Form 1040X from the time you file your return, if you make a mistake or something missing when you return.

If you paid the tax sometimes after you file, you have up to two years from the date you paid the tax.

If you discover that you have been missing tax relief for years; for example, if you discover that you qualify for the earned income credit but did not take, you can not change the yields for the last three years and get a refund.

0 Komentar