Staying in the dark with the Blues ready students -

How do I repay my student loans and still pay my bills?

This is the time of year when the proud parents of upper-class gather to watch their children prepare to obtain a university degree.

After the hats are thrown, tears are wiped away and the celebration cake went-graduates will start their new life in the real world.

But many classes of recent graduates face a miserable job market where there may be as many as ten candidates for each job. Therefore, one of the most daunting tasks becomes the challenge of not falling behind on student loans.

Although hard times can build the moral fiber, you do not want to build character by participating in the debt trap.

as the mother of seven who saw the difference between his studies with a student loan debt in relation to freedom of debt free, I know the value of trying to stay ahead of these loans .

I think every college graduate can properly manage their loan debt for students by understanding how the system works.

understand the consequences for getting behind on student loans

as a mother of children in college, and a recent graduate, I know personally, the difficulty of labor market and what challenge these graduates face.

First, there will be interest for late payment and the costs that inflate the amount you owe- and chances are good that you can have too much like that!

If you default, the government can garnish your wages and withhold your tax refund. Not to mention a huge success on your FICO score, when you are starting out and trying to build a good score that will help you get lower interest rates on a car or a house.

This is not a good way to start your post-university life!

Understand your grace period

borrowers usually have a few months after graduation before you must start repaying your federal student loans.

For most federal student loans, the grace period is only six months. Most loans have up to ten years to repay.

It is important that you contact your loan provider and find out when the states begin, especially if you have not yet received notification.

Understanding the Qualifications for reimbursement programs based on income

Under this program, your loan payment may be reduced based on the amount of discretionary income you have.

In most cases, your loan payments will not exceed 10% of your total income. After 25 years, what you still owe on the loan will be forgiven

It is not automatic. you definitely need to apply for the program by contacting the company that serves your student loan.

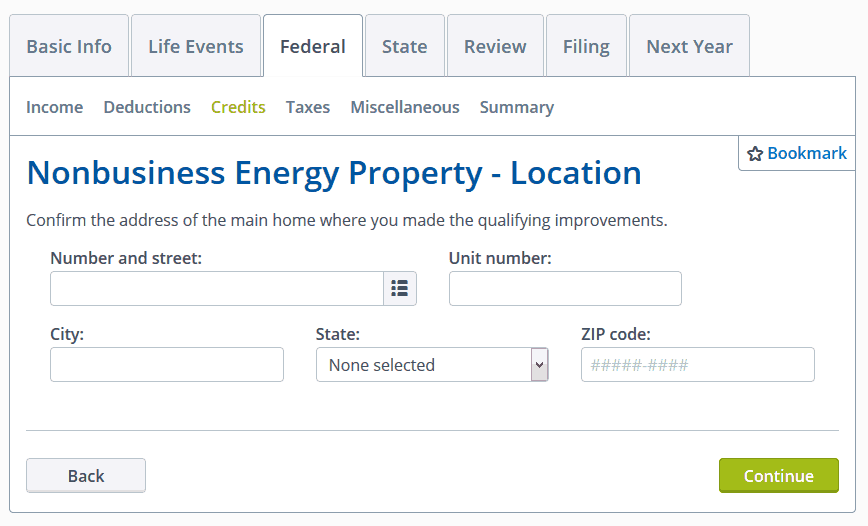

If you have moved a couple of times and your loan documents have not been transmitted to you and you do not know which services your student loan, then you can go to the system's database National student loan data.

you will also need to authorize the IRS to provide the tax return on the Ministry of Education last year. If you feel that your return does not reflect your current situation, there is a form you can use to show how your situation has changed.

Learn about these forms and criteria, as well as links to major student loan services to IBRinfo, a website that is set up by the Project on Student Debt.

Understand the options "Quick Fix" deferment and tolerance

If your new job begins in six months or if you have an unpaid internship or if you are unemployed, yet the school or experiencing economic hardship, you may request that your deferred payments on federal student loans for up to three years.

for subsidized Stafford loans (provided to students who demonstrate financial need), the government will pay the interest on loans for the adjournment.

interest on unsubsidized Stafford loans will accrue during the deferment. If you are not eligible for deferment, then you might still be eligible for forbearance, which allows you to put off payments up to three years.

is more difficult to qualify for the deferral for abstention because in forbearance, you will still have to pay accrued interest.

understand how important it is to start Paperwork Early

It is important that you continue to make full payments until you are notified otherwise. It takes longer for income paperwork reimbursement basis to get treated and does not take as adjournment and patience because the latter two are temporary relief loan payments.

Whereas the repayments based on income could be a longer-term, depending on how long you are in this work and that salary.

it is important to look forbearance and deferment that short-term fixes and not long term which is why it is essential to file for these right away, while you are looking for a job.

But if it looks like your payment problems will last longer than a few months, you definitely need to look repayment based on income.

Understanding the option to extend the term of payment

If you are a borrower owes more than 30K, most lenders will allow you to extend the duration beyond the norm 10 years, reducing monthly payments.

the amount of interest you pay will increase, though, especially if you extend the payment of the maximum period of 25 years. And who wants to spend the next 30 years to repay a student loan? I recommend this as a last resort option.

Try to pay in 10 years of standard time so you can avoid thousands of dollars more in interest.

Understand the company options for private student loans

The outlook is not as sunny for those private loans. You have fewer options.

private educational lenders do not participate in the rebate program based on income and they are not required to allow you to defer payments, even if you are out of work.

If you have problems with your private loans, read your loan agreement. It may require the lender grant you forbearance under certain conditions. Even if your contract does not contain a provision of economic hardship, your lender may be willing to provide relief.

Some lenders have become more flexible in this post-recession environment great. You could ask for interest-only payments or even to modify the loan terms. (More info here at Student Loan Borrower Assistance)

Based on what you just read, what is one thing that you can do this week to stay in the black and avoid student loan blues?

photo credit: aluedt via photopin cc