These days almost everyone accepts plastic, including IRS.

Thanks to the Taxpayer Relief Act of 1997, the federal government accepts tax payments on the income by "any commercially acceptable means," which includes debit and credit cards.

but just because you can do something, it does not do not necessarily mean you should.

More often than not paying your taxes with a credit card is not the best choice.

expense?

When you buy something with a credit card, the merchant incurs a fee which is usually 1.5% to 3% of the purchase price

Normally, this is an expense you. - consumers -. will never see, because the merchant eats as a cost of doing business

now, do you think that uncle Sam will do the same? Fat luck.

the IRS charges you for processing fee of your card payments. The good news is that they have negotiated fees that are well below what most companies have to pay. The bad news is that these costs are still very high

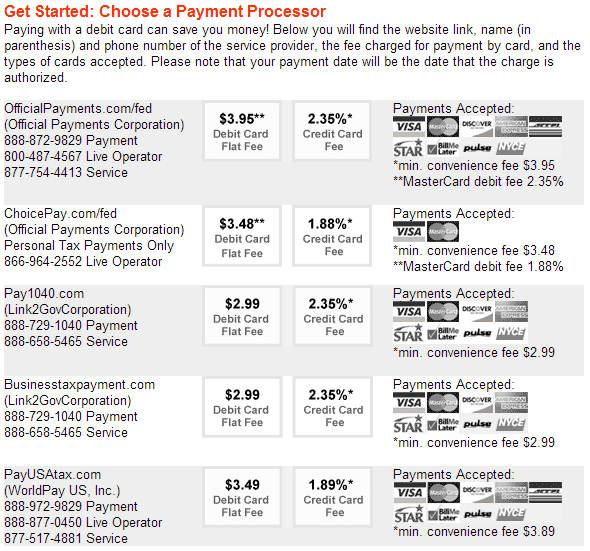

There are five licensed processors and here they ask :.

Thus, in the best case, you will pay at least 1.88% of the amount.

This might be acceptable if you have a few hundred dollars, but if you pay thousands of dollars that the tax can be a lot of money.

In the worst case, you not only pay this fee, but you are also paying interest on your credit card (if you are wicked and wear it as a balance).

But if you have no other choice, most people would probably say that it is better to be indebted to Chase or American Express as intimidating IRS!

rewards?

On the positive side, paying with credit can save you money-back, airline miles or other rewards. But will value they exceed the cost of treatment? Usually not, but it is possible

Some cards give you rewards worth 2%, but not many

You can count on one hand all ..; Capital One Venture, Fidelity American Express, Priceline Rewards Visa and Capital One Spark Cash for businesses.

If you use one of those, then you can get ahead, but not by much.

Unfortunately, with most other cash back cards, you will earn 1%, so that they will be a losing proposition.

The same goes for most airline credit cards, as the miles are seldom worth 2 cents each. In fact, sometimes they are worth less than a penny a piece!

For example, the Delta SkyMiles program is notorious known as "SkyPesos" in loyalty circles, because the award flights may require a lot more miles than the standard 25,000 you pay with most other carriers.

another possible scenario where you can get ahead is by using a registration promotion for a new card.

Many offer bonus points or cash if you spend a certain amount in the first 0 days of opening the account.

For example, you may have to spend $ 3,000 in the first 3 months to mark the bonus.

for some of us, our normal credit card spending may not be high enough for it. But if you charge your taxes on the card, which could put you at the finish line.

Of course, you always pay the processing fee, but perhaps worth it if you get a free ticket or a nice sum of money in return.

Conclusion? You should probably stick with controls

Except for a few cases, it probably will not make much sense to pay with credit.

Rather than pay the heavy processing fees, consider using checks or ACH (electronic checks).

cards are another good alternative debtors from those involving a reasonable flat fee of just a few dollars. If you are lucky enough to have a debit card with rewards, keep in mind that you do not win awards on PIN-based transactions, which unfortunately is what your tax payments will be.

Photo credit: marsmet543 via photopin cc

0 Komentar