![What to Expect When You’re Expecting a Refund [Infographic] - TaxAct Blog](http://blog.taxact.com/wp-content/uploads/What-to-Expect-When-You’re-Expecting-a-Refund-Infographic-15.jpg)

You have successfully organized and received your tax documents to e-file your taxes fast with TaxAct. Congratulations!

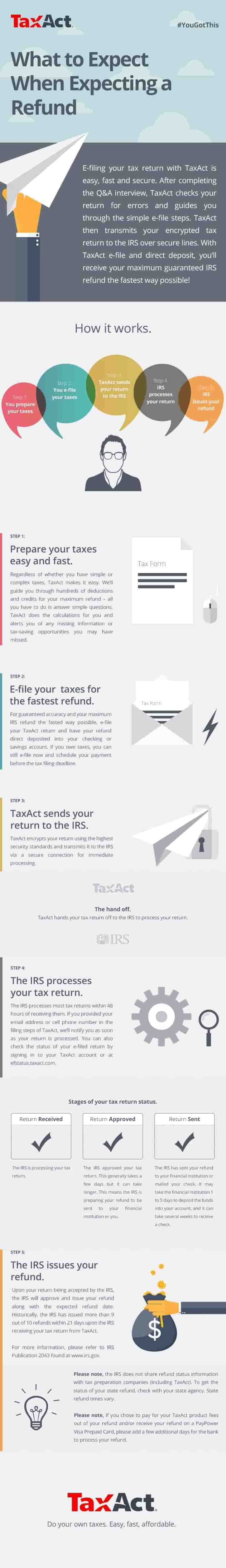

Now, where's my refund?

How the e-file process and reimbursement works is a frequently asked question we get.

The short answer is ...

your tax return with TaxAct is easy, fast and secure electronic filing. After completing the Q & A interview, TaxAct checks your return for errors and walks you through the simple steps e-file. TaxAct then transmits encrypted your tax return to the IRS over secure lines. TaxAct With e-file and direct deposit, you will receive your guaranteed maximum refund IRS as soon as possible.

The more detailed answer, however, in what you can expect when you are expecting a refund is in the following infographic ..

Click here to view a larger version

additional resources:

you can check the status of your e-filed statement connect to your back or TaxAct efstatus.taxact. com. Remember, the day of repayment of IRS statements made not more than once every 24 hours, usually overnight.

In 2015 IRS refund season FAQs taxes here.

For more IRS refund information, click here.

0 Komentar