Complete Tax Planning Guide for New Parents -

Having children changes everything - even your tax planning

Whether . new parent or you're in the occupied intervening years of raising children, it is important to understand the tax issues so that you can plan ahead.

Here are some tax issues, the adoption of Zoo memberships, which can affect you as a new parent:

adoption of credit

the adoption credit is quite amazing

[

Unlike most funds, which return a portion of your expenses, adoption credit repayments your adoption expenses on a dollar for dollar basis.

You can get a credit for up to $ 13.10 in 2014.

If your modified adjusted gross income in 2014 is $ 197,880, your credit is reduced. If it is $ 237,880 or more, you will not be eligible for this credit.

A babysitting service

If you pay someone to care for your child while you work or look for work, you may be eligible for a credit up until to 35% of the first $ 3,000 you pay them.

for two or more children, the credit can be up to 35% up to $ 6,000 in fees.

If your income is above $ 15,000, the percentage used to calculate the credit is reduced. If your income is between $ 15,000 and $ 17,000, the credit is 34% of your expenses if you are eligible.

If your adjusted gross income exceeds $ 43,000, the percentage is 20% of spending. You can take this credit until your child turns 13.

children Credit

It does not matter if the baby comes in January or December - if you have a new child during the tax year, you may be able to claim a child tax credit of $ 1000

you can take this credit each year until your son or daughter turns 17.

the credit phases at higher levels of income. - Expect a lower credit if your adjusted gross income is $ 75,000 or more ($ 110,000 if filing jointly).

If you are in the lowest tax brackets (use this calculator to find out what tax bracket you are), the credit is refundable.

This means that you can get a refund even if the credit exceeds your income tax for the year.

dependency exemption

Each child you can request a dependent reduces your taxable income by $ 3.950 in 2014.

this will save you almost $ 1000 if another you are in the bracket of 25%.

Again, it does not matter when your child is born during the year.

Earned Income Credit

it is possible to apply for Earned Income Tax Credit, or EITC, no children, but it is more difficult.

If a joint statement with no children, the credit phases completely when your income exceeds $ 20,020 in 2014.

If you have only one child, however, you can earning $ 43,941 in 2014 on a joint statement. Income limits are higher with two children, or with three or more children.

State deposit

If you are single, you generally use the single filing status.

However, if you pay more than half the cost of maintaining a household in which your qualifying child lives, you might be able to use the head of household filing status.

you might be able to use the head of household filing status even if the child's other parent claims the dependency exemption. You generally pay less tax by using this status by filing as single.

Savings Plans of higher education

The sooner you start thinking about the cost of higher education, the more your savings plan will be.

Start search in Section 529 savings state education plans.

you will not get a tax deduction when you contribute to them, but the plan grows tax free, and your child may qualify. tax free withdrawals

you can get a tax deduction when you contribute the state - check with your state. You, not your child remains in the control of a 529 plan, and there are no income restrictions.

Coverdell education savings accounts (ESAs) are another way to save for college. An ESA is opened in the name of a child. If you use this plan, you'd better start early. No more than $ 2,000 can be deposited in an ESA in a year.

IRA for children

of retirement planning for young people? He is not crazy after all. Tweet this

If you look at how much even small investments can FARE enough years data, you may wish you had put a part of your child care and lawn money mowing in retirement accounts, too.

In addition, the money was not coming in because of earned income for the child. Contributions may come from you or grandmother, just as long as there is no more $ 5,500 per year, or income earned from the child, whichever is less.

Kiddie Tax

If you are in a high tax bracket (use this calculator to find out what tax bracket you are), you may have noticed that if your child was to produce a statement, his tax bracket would be much, much lower.

All you have to do is transfer of productive assets from junior to income, and leave rake in income and pay tax at the lower rate.

sounds good, right?

Unfortunately, what has been tried.

accordingly, we have the so-called kiddie tax. After the first $ 1,000 of capital income of a child (interest, dividends, etc.), the child pays the tax on the next $ 1000 to a clean rate of the child.

If he or she has a more unearned income is taxed at your rate. A "child" for the child tax remains a child up to 19 years, or 24 if he or she is a dependent student and full-time.

Rebates for child care

Instead of the dependents of credits for children and you might be able to use a reimbursement account at work.

If this plan is available to you or your employer may be able to contribute up to $ 5,000 per year in this account and use it for child care expenses.

money you put into this account escapes both the social security and income taxes, which could save you more money than you win by claiming the childcare credit children.

This type of plan is also considered a benefits to dependents.

Social Security numbers

before, people to wait until they needed a Social Security number before they apply for one. This could be years down the road.

All that has changed.

Now you must apply for a Social Security number as soon as your child is born, or you can not claim him or her as a dependent on your tax return. If you try, you could face a fine from the IRS. Tweet this

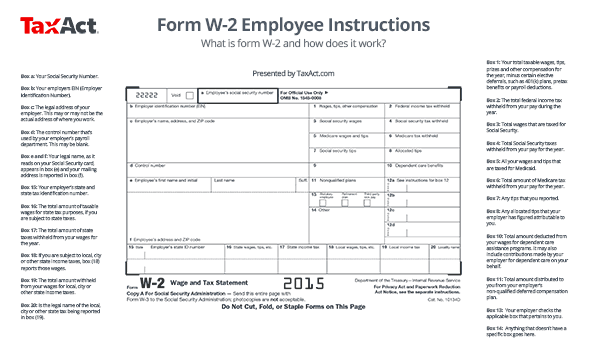

Withholding Adjustments

Having a child can help you save on income tax.

Why wait until you file your return next year to start getting a bigger salary? Adjust your withholding to have less tax withheld?

Use TaxACT to estimate the exact amount of tax you should have withheld and to prepare a new W-4 form to take to your employer.

Zoo, Museum, and other memberships

during child rearing years, you can visit the zoo, the aquarium, and other recreational places more frequently than you ever imagined.

Not only are annual passes usually much - and easy bypass the long ticket lines - but part of your membership may be tax deductible as a charitable contribution

L organization can tell you how much, if any, on your number of passes. as a deduction.