Do you file your taxes for the first time?

Are you feeling a little overwhelmed about the whole process?

filing a tax return for the first time can be intimidating.

Here are 5 tips to help you in the process.

1. Determine if you need to file

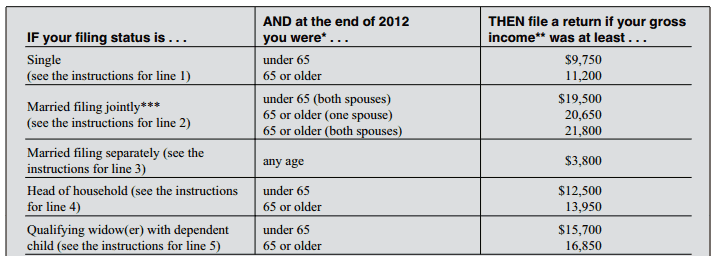

Three things must be considered when determining whether you must file a federal tax return returned; filing status, gross income, and age. In general, once you reach a certain level of income, the law requires you to file.

See picture below for the status of federal income tax on the income of most people.

Although you are not required to file, you must file for a refund of federal income tax withheld or to take advantage of tax credits you may be eligible for, such as:

- Earned credit income

- additional credit child tax

- US credit possibility

- credit Federal fuel tax

- refundable credit for prior year minimum tax

- tax credit for health coverage

2. Get organized

Save time by organizing before preparing your tax return. Use a checklist to help determine what information you will need.

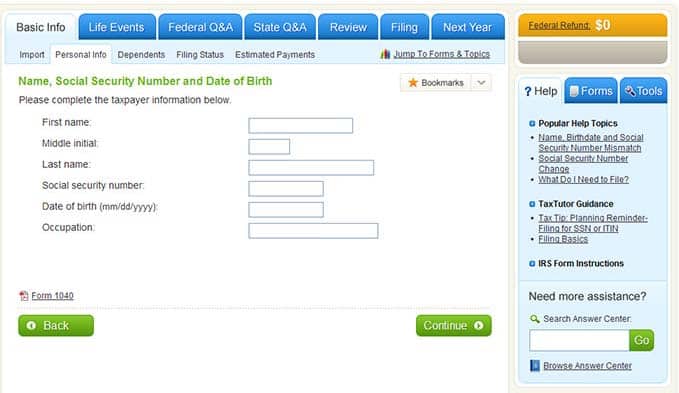

In addition, it facilitates the use of TaxACT software because it provides a step by step guide through the federal state and Q & A interview screens. Having this information readily available, it is a much smoother process.

3. Understand the difference between tax deductions and credits

A deduction will reduce your taxable income. Of this amount of taxable income, you understand your tax debt.

A credit will then reduce your tax debt. There are non-refundable and refundable credits.

A non-refundable credit can reduce your tax to zero, but it can not result in a refund. If your tax liability is zero, you receive this type of credit to everyone, even if you are otherwise eligible.

A refundable credit can increase your refund or reduce the amount you owe. You may qualify for a refundable credit even if you do not have tax withheld federal income.

4. File your return on time

The IRS publishes its deadlines each tax year. For the 2012 taxation year, the tax return date individual maturity 15 April 2013.

If you are not able to file by that date, you can request an extension of 6 months. You can do this by completing Form 4868 or pay your estimated tax due, which can be completed in the TaxACT program.

5. Know the record keeping requirements

database records are documents that everyone should keep. These are the documents that prove your income and expenses. If you own a home or investments, your basic records must contain the documents related to these items. For example:

Revenue

- Forms - W2, 1098, 1099, K-1

- bank statements

- brokerage Accounts

Expenditure

- sales slips

- Recipes

- bill

- proof of payments

- written communications to qualified charities

Home:

- closing statements

- purchase and sales invoices

- records Insurance

- received for improvement costs

Investments

- brokerage statements

- statements of mutual funds

- Forms: 1099, 2439

- received for collectibles

please note, there may be keeping requirements more detailed records depending on the specific items on your tax return, as the itemized deduction for charitable contributions

photo credit :. Dricker94 via photopin cc

0 Komentar