Generous Gift Buying Guide for a budget -

How can I buy all the gifts I have to give and still stay on budget?

since I was a child, I am a born giver. My mother scolded me because I gave my doll at a girl.

"Why did you, Ellie?" My mother said as she shook her finger at me.

"Because I had two dolls and did not all!"

I still love to give gifts, but I do not want to go on the budget and to my family to pay the price for my generosity.

by following the tips listed, you and I may as well stay on budget and still be generous donors.

The Number one Gift Choice :. Gift Cards

you are shopping for a birthday present, holiday gift or birthday surprise the chances are better than not that you will consider purchasing a gift card for that person on your list

But there are some things you should be aware of before you buy.

Closings store. once you have purchased the gift card, a store may close. You really have to be careful in buying gift cards because when a store files for bankruptcy or closes, it is up to the bankruptcy courts and too often they are not to honor gift cards existing.

Some stores closed in recent years have moved away from $ 20 million in unhonored cards!

fees on gift cards. in 2010, the Disclosure Act (CARD) Accountability credit card responsibility and was set up to protect consumers and retailers in the field of gift cards.

This protects brand prepaid cards (AMEX, Visa, MasterCard) have an expiration date of less than five years after purchase.

further, dormancy, inactivity and service fees can not be charged after 12 months

. Warning: some of these cards can still charge a fee every time the balance is checked, the card is used, the customer service is called, or if you need a replacement card. Read the fine print before buying.

The stolen numbers. Before buying a card, especially one that is hung on a gate in the public (as in a grocery store), inspect the card to ensure that the stickers are not deleted and the PIN numbers are not visible . Or apply for a card that is behind the counter or has not been filled in the rack.

Make sure you also get a receipt of purchase activation when you give to others. Thieves are writing numbers and pin, then periodically check online to see when the cards are active, they steal the card balance.

Gift cards are always a popular and convenient way to go in today's economy.

In fact, some families may enjoy a significant discount card to a retailer because it will allow them to buy groceries and clothing.

If you pay attention to the details of the gift card, it can be a great gift to give.

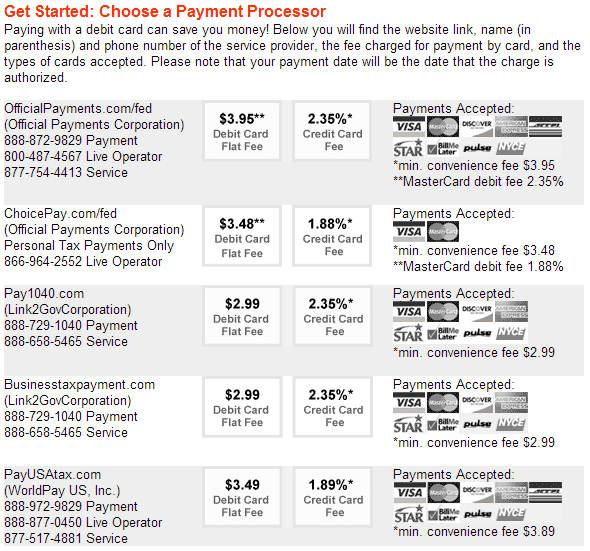

Buy Online

a way to stay on budget is to "layer economies"

The steps to save big online.

1. the first step is to go to MySimon, Amazon and Bing, which are robots that search the Internet for your article to find the best deal possible shopping.

2 . once you've found the best deal, the second step is to go to a site code as RetailMeNot and CouponCabin to find the codes you need to save even more. Sometimes these codes for free shipping , gifts or discounts.

3. The last step is to get a refund for your shopping, going to Ebates or SlickDeals.

on some of these sites, for example, you have an account and get your friends to sign up under your account, you can earn $ 5 per referral. There are hundreds of sites online participants that will give you a discount off your purchases and you get a check at the end of each month

Purchases year :. When to buy and when not to buy

one of the best ways to save is to pay attention to the schedule and buy gifts when they are in seasonal sales.

a new set 1000 son-count Egyptian linens for your student can be a great gift, especially if purchased during a biannual white sales so you pay half the price

Here's a guide when you need to buy some items to get the best offer :.

Toys. although it is difficult to beat the post-Thanksgiving and Christmas sales, there is another good time of year to buy-August

Not only can very tender be collected on summer toys as play equipment and pools, but other "high" space objects are erased in preparation for next season stock toy. This can save up to 65%.

Video Games. new games of the season are usually released during the holidays and it's time to find the best.

But if the price is a consideration, then just wait until January or February, after the initial hysteria died down and the savings can be even greater.

television and electronics. Yes, the eruption of the electronic sales usually occur around the holidays, but April is really a better time to find deals in this category.

most Japanese companies end their fiscal year in March. This means new models come on the market and it's time to get rid of last year's models. Rates for as much as 20% to 25% or more can be had during this period of the year.

Are you a born giver? If so, which is how you plan to record as you give to others this year

Credit: kevin dooley via photopin cc