Can tax preparation software help you find deductions, pay less taxes, and remain in trouble with the IRS and a living person sitting opposite you can?

For most taxpayers, today's tax preparation software can do a great job on all of the above.

In fact, the tax preparation software has some advantages.

After all, he is always patient, always guide you every step of the way, and it never suffers from burnout tax season.

he did not even complain if you wait until the last week before the deadline to begin.

to get the most of your tax preparation software, however, you must use it right.

If you take shortcuts, for example, you may miss the benefits of going through the federal and state Q and A sections

How to use the software tax preparation confidently :.

1. Organize before starting

In January, you should have a file for all tax forms year-end that begin to appear in your mailbox .

When you're ready to do your tax return, sort them by type of income or expense.

Put all your W-2 forms together, and all your declaration of dividends and interest, for example.

You'll want to go through each section of the program once, if possible.

If you keep track of your finances with personal finance software, update your file and print relevant reports.

It is important to keep track of how you came up with the numbers you enter the tax preparation software.

Create a list or spreadsheet with notes on how you estimated amounts, how you valued charitable donations, and anything you might need to remember later.

you must also keep track amortized mortgage points, all you'll need to refer to later years.

If you download the program, make sure you have the latest updates before starting.

2. Go through the Q & A interviews to

It is possible to directly access tax forms and start filling them.

Unless you are a tax pro, however, resist the urge to do so.

You defeating much of the purpose of the tax preparation software by jumping full Q and A sections, or jumping around too much from one section to another.

Entering information in the tax preparation software without going through the Q & from start to finish would be like going to a tax and debiting your professional tax numbers without leaving the pro talk tax or ask you questions.

Either a tax preparation software or a tax professional is bound to ask you some questions that are not applicable.

do not get discouraged and start jumping around.

TaxACT is designed to ask you a few questions as possible and always make sure your taxes are done correctly and to your best advantage.

3. Enter a section of your information both

Try to deal with every piece of paper related to tax only once. After you enter an item, a check mark or other mark lets you know that you are finished with this article.

You can use your spreadsheet to take note of all the questions you have as you go along.

It is normal to discover that you just need a receipt, or other account interest income.

do not let the fact that you do not have any stall your work.

for a significant number, such as property taxes, if you can not find a phone number, you can enter an estimate.

most of us are eager to see the grand total of the tax due or to be paid back, and the seizure of estimated amounts can help you do it.

right-click a text box, then click Mark estimate. TaxACT will remind you double-check the number before filing.

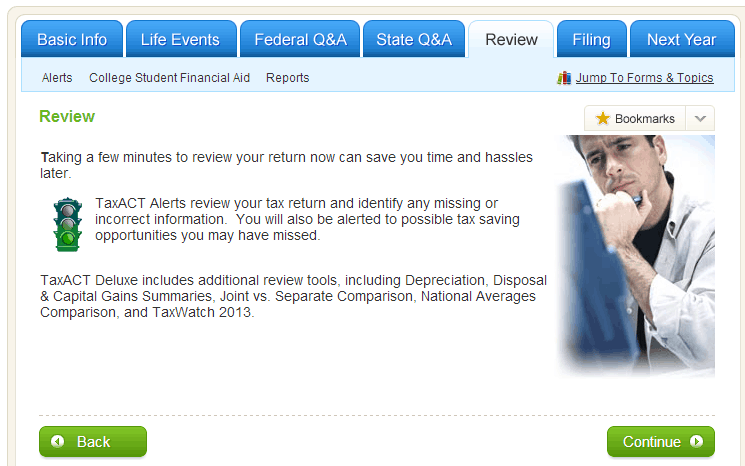

4. Review before filing

You've reached the end of the Federal and State Q and A sections, but you're not.

Use Review Main tab to check for missing or incorrect information.

TaxACT will not let you drop before correcting certain errors and omissions.

other items can not help you deposit, but you should check to make sure you get all the breaks you are entitled.

you should also read your tax return.

It is easy to think that if you have entered all your numbers, your return should be 100% correct.

However, you are responsible for reading your return and making sure it is right.

For example, if you enter the car mileage for your small business, but you just miss a check box in the questions, the program can determine that you are not eligible for the deduction.

by comparing the elements you expect to see on your return to income and deductions on the actual form, you can make sure everything is entered correctly.

How long will even let you work on your tax return?

photo credit: ebayink via photopin cc

0 Komentar