From time to prepare and file your tax return, day you will find your refund tax in your mailbox or bank account, you are never alone.

Here is a timeline of your tax refund and where you can find help when you need them.

where's my refund

Step 1 :. Prepare your tax return

Using TaxACT, all you need to do is answer simple questions. TaxACT does the rest -. Check the tax laws for breaks and possible tax limits, perform calculations and alert you of any missing information or opportunities for tax savings that you missed

Whether you have simple taxes or complex, TaxACT makes it easy and fast

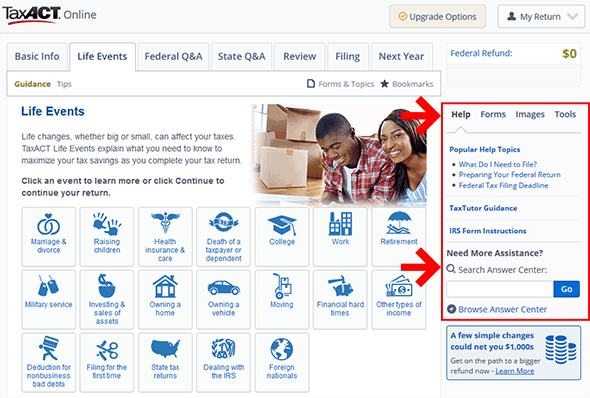

Where to find help :.

TaxACT explains each issue easy to understand language. If you need more help, look for popular help topics on the right side of your screen or search the Response Center

Step 2 :. . file your tax return

You can always print out and file your taxes the old way.

For faster filing, safest, however, e-file your return and your refund directly deposited into your savings or checking account.

your return will be delivered to and processed by the IRS more quickly, which means your money can be deposited directly into your account much earlier.

If you owe taxes, you can always e -file now and plan your payment before April 15.

Step 3 :. TaxACT send your tax return to the IRS

Once you've done your part, you can sit and relax.

TaxACT encrypts and transmits your return electronically, using the highest safety standards to the IRS via a secure connection for immediate treatment. - No stamps, envelopes or trips to the post office required

Step 4 :. The IRS processes your tax return

The IRS usually processes returns within 48 hours of receipt

If you have provided your email address or cell phone number in deposition steps of TaxACT. You will be notified when your return is processed

Step 5: Wait for your refund ..

waiting may be the hardest part, especially if you are expecting a significant refund.

This should not however take a long time ,. Once your return is accepted by the IRS, the agency will approve and issue your expected delivery date of repayment.

Most reporting, 9 of 10 in fact, receive a refund within 21 days after the IRS received your return.

for more information, please refer to IRS publication 2043.

Where to find help:

After 21 days come and go (30 days if you mailed your return), and you have not received your refund, check the status of your IRS refund in line with "Where's my refund" tool www.irs. gov.

Remember, the IRS updated "Where's My Refund information" once every 24 hours, usually at night.

If you receive a refund state, see the website of your state agency for a similar tool auditor of the state of refund. repayment periods vary from state

S 'please note: .. IRS and the states do not share the reimbursement status information with tax preparation companies (including TaxACT)

please note: if you choose to pay your TaxACT products cost from your refund and / or receive your refund on a prepaid card PayPower ™ Visa®, please add a few extra days for the bank to process your refund

your turn.

If you received a large refund, would you consider adjusting your withholding so you can keep more of your money throughout the year?

Leave a comment below

0 Komentar