Each week we will meet one? the most frequently asked questions on the blog of Facebook, Twitter and TaxACT in "You Got It" weekly series

issue :.

I worked part-time throughout the year and I also collected unemployment. I get $ weekly to unemployment and $ 100,180 each month for part-time work. I have two dependents and want to know if I will get a tax refund this year.

Joy via Facebook

answer

There are four areas to consider when estimate your tax refund before you actually complete your tax return

[ please note there are many other factors that can affect the amount of your net refund, but this information will give you a head start on estimating your potential refund

income :.

Any income earned during the year should be claimed on your tax return. After your total income is calculated, the standard deduction (or itemized deductions) and personal exemption amounts will be deducted in determining the amount of your taxable income.

Therefore, what is considered income?

The main source of income for most taxpayers is generally full-time wage or part-time job. Salaries are usually reported to you on Form W-2 issued by your employer.

If you worked several jobs during the year, you should receive a W-2 from each employer.

Enter all your W-2 forms in your tax return. If filing a joint return, you and your spouse should enter both your W-2 form.

In addition to wage income, you can also have investment income, commercial activities, pension plans or other income.

investment income may include interest income, dividend income and capital gains or income loss.

Some common forms that investment income is reported on are the 1099-INT form, Form 1099-DIV, 1099-OID Form 1099-B, and 1099-S form.

commercial activities could be starting your own business, farm income, rental income, or income from royalties. These types of income are reported on Appendix C , Annex E or Annex F.

income of a pension plan may be from an individual retirement account (ARI), a pension or an annuity and will be reported to you on form 1099-R.

besides the types of income mentioned above, you can also have an unemployment benefit income (Form 1099-G), play gains (W-2G form), alimony, security benefits social (SSA-1099 or form RRB-1099), or miscellaneous income (form 1099-MISC) to name a few

filing status :.

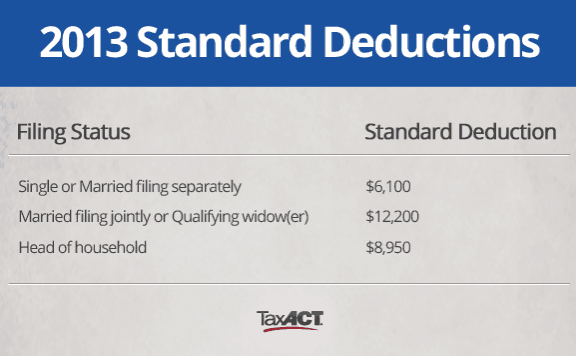

your filing status determines your standard deduction, a fixed amount is deducted from your income. This deduction is used to determine the amount of income for which you are taxed

For 2013, standard deduction amounts are as follows :.

When filing your return, you can choose to use the standard deduction or itemize your deductions using Schedule A.

Some deductions include income taxes to the state, the common detailed property taxes, charitable contributions, mortgage interest and medical expenses

Generally, you must request by deduction results in a larger refund (or less tax due)

dependents / Exemptions: ..

Claiming a dependent on your tax return generally has an effect positive on the amount of your refund.

In addition to the standard deduction (or itemized deductions), you can generally claim a deduction for personal exemptions.

If you can be claimed as a dependent on the return of another person but are still file your own tax return, you must indicate in your statement. You're also not allowed a personal exemption because the personal exemption may be claimed in the statement on which you claim. If you claim a dependent on the return of another person, your personal exemption is claimed on the return of this person.

If you are able to ask you in your own tax return, you are entitled to a personal exemption.

If you file a joint return, you are entitled to a personal exemption for your spouse. You can claim a personal exemption for each of your dependents as well.

For 2013, the amount of the personal exemption is $ 3,00 per person.

The amount of the personal exemption is similar to the standard deduction in that it reduces your income to find the amount of your taxable income.

plus additional personal exemptions for dependents, claiming a dependent on your return may also qualify for tax credits.

Dependents are included in the amounts of the following mutual funds: child tax credit, tax credit for each additional child, obtained income credit, and the child and dependent care credit

tax credits.

now that we've talked about what determines the amount of your taxable income, you can estimate the amount of your refund

tax credits can be classified in two ways - non-refundable tax credits and refundable tax. credits.

non-refundable tax credits are just that, not refundable. This means they are limited to the amount of your tax. These credits can not be claimed until your total amount of tax, resulting in a total tax of $ 0.

If you have a non-refundable tax credit and can not claim the full credit because the amount of your tax is less than the credit, you will not receive a refund for the amount that exceeds the amount your tax.

refundable tax credits , on the other hand, are not limited to the amount of your tax. Refundable tax credits, in addition to offset any amount of tax, may increase the amount of your refund. You will receive credit for a refundable credit regardless of the amount of your tax.

Some common non-refundable tax credits are the child credit and dependent care expenses (form 2441), education credits (Form 8863), the credit child tax (Schedule 8812) and residential energy credits (5695 form).

Some common refundable tax credits are payments of withholding taxes on income, estimated tax payments, earned income credit (EIC annex), credit tax additional child (Annex 8812), and the American Opportunity education credit (Form 8863).

Payments are withholding reported on Form W-2 and Form 1099 you receive. the estimated tax payments are payments that you send to the IRS to pay income tax on income not subject to withholding during the tax year.

How can I estimate my refund?

The best way to determine your repayment amount is enter your information in your return TaxACT Free Federal Edition and let TaxACT do all the calculations for you. You can also use TaxACT TaxCalculator of .

Start your return TaxACT Free Federal Edition safe return now. We are committed to guiding you to your largest federal refund!

For "You got that" weekly series issues here.

0 Komentar