How do you want to graduate from college with no debt loan student?

as the mother of seven children, I work hard to keep our children free debt, especially regarding student loan debt, because we know that one day they will have to repay these loans

Not every graduate student with no debt, but there is much that can

in fact, the amount of loan debt for students that you can actually determine the following aspects of your life after you graduate :.

- employment -. the type of job that you have the freedom to accept because of your debt

- Transport - the kind of car you can afford to drive after making loan payments students

- housing - .. if you live in an apartment with several roomies or if you have enough funds after payment of debt to live alone

for example, our daughter Bethany just graduated a bachelor's degree in the field of electronic media. She sought a job in Chicago all summer and took the job as a nanny to hire.

At the end of the summer, a dream job opened in England where she happen to live abroad for a year and traveling all over Europe to the company in charge part of its work.

It is to love life on a team of creative arts and using his major in the field of social media while seeing castles, cathedrals, historic sites and other crops.

because the work does not pay well beyond the costs of travel and accommodation, the only reason she could not accept this incredible opportunity was because she has no loan debt student.

Finish college with a minimal amount of student debt loan

I think every college graduate can finish school with a minimal amount of student loan debt (or no debt at all) taking into account all available options to minimize costs.

Here are some points to consider in order to save on college expenses:

Make the right choice

Change the Conversation "I'll go to the best college I can get in "to" I will go to school where I can get the best education possible for the least amount of student loan debt. "

Our son, Daniel, chose the University of Texas (Arlington) on the stock exchange he got to Syracuse and TCU because it would still have 60K to 80K in student loan debt after grants ran out of those other schools.

he graduated with honors and a degree in journalism. he is a writer working in Texas, to live life free of debt and does not regret his college choice .

Make dual enrollment a priority

Many high schools offer high school students the opportunity to take college courses either on campus or in collaboration with the local community college.

student gets credit for the needs of high schools and double dips earning college credit at the same time. in fact, there are thousands of students across the country who graduate school a week and their associates degree from the local community college next week!

Our children orchestra, choir, ballroom dancing, yoga, World History, Physics, and calculus while still in high school and dual enrollment, they received college credit for their efforts.

Making hunting purse of a working part-time

millions of dollars in scholarship money go unclaimed every year.

This is free money that parents or prospective students who are willing to do some detective work can find more quickly than they think.

Go to collegeboard.com or salliemae.com to find scholarships that could be a solution for you. Do not apply for a dozen awards, take the time to cut and paste and apply hundreds of them to see that money come to your college account.

Making use of Advanced Placement testing

you are in high school and take an AP test for college credit or you are already in college and want to go a language CLEP test to advance a few hours you can study and pay in a big way.

There may be other tests that your university offers to give you a credit for the knowledge and skills you possess.

One of the Kay family members placed on the 16 Spanish units, which was equal to $ 4,000 recorded in tuition and books!

Make a budget and stick to it

Go to elliekay.com for an interactive budget tool and learn to live within your means in order to minimize debt.

Make yourself accountable to a friend or relative who is good with money. They will ask you on a weekly basis how your budget is.

This concept of responsibility will make you more likely to stick to a spending plan and help you live within your means.

Make Yourself a Fellow or Associate

many colleges and universities offer programs that allow you to get a master's degree by research or to help teachers in department in which to study.

This is a viable option that also improves your hands on experience in your chosen field.

Our son, Philip, received her Masters from Stanford, debt free, becoming a research assistant (RA) and assistant (tA).

He interviewed for the fall semester during spring break of her senior year in college. They were so impressed that he took his spring break to try to get a job for his master's degree they have hired locally.

In her new role as a TA, he was able to help four fellow college get the same kind of opportunities when they came to get their master's degrees.

Make an agreement with your employer

many employers are willing to pay the bill for the master's degree, especially an MBA (Master of Business Administration).

Talk to someone in the department of your company's human resources for more information. Or another option is to talk to a military recruiter to join the guard or reserves.

The Army, Air Force and Navy will often pay up to $ 65,000 of student loan debt if you are eligible.

Currently, nearly 20 million Americans attend college each year with 60% of students who borrow each year to help cover costs.

The average balance of student loans is $ 24,301 and many borrowers owe significantly more than this amount (beep and share).

you can beat these statistics and graduated with a nominal student loan debt by making choices intelligent colleges.

Which of these options do you work today to minimize your college costs

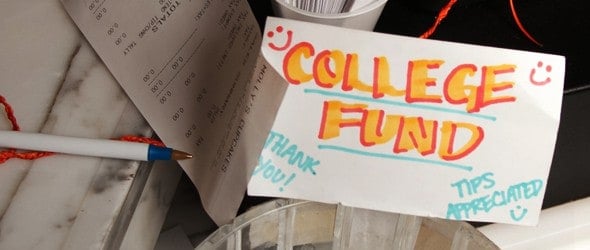

Image Source: leetlegreenman

0 Komentar