The biggest question most Americans have when they get their tax refund on income is: where do I spend it?

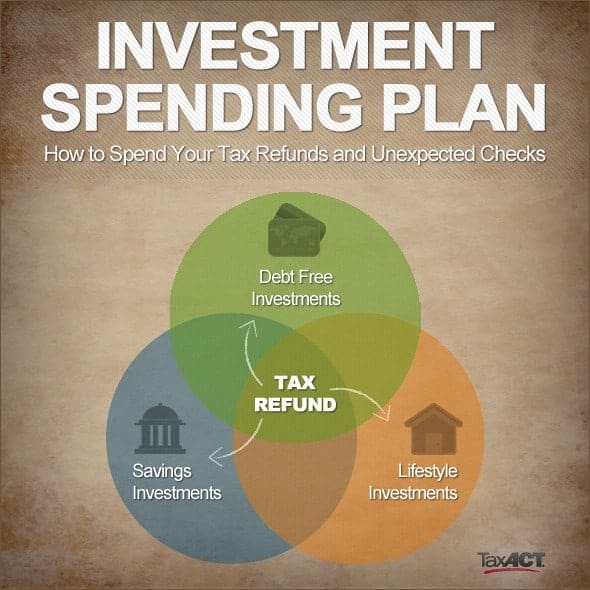

I believe you can make a wise choice on how to use your tax refund that will have lasting benefits by learning "Investment spending plan" method.

I developed the capital expenditure plan when my husband and I were married and we occasionally get an unexpected check in the mail. Whether a birthday check from my grandmother or an insurance refund check, our first thought was to ensure that we pass on something that can be considered as an investment purchase, rather than just blowing.

When it comes to your tax refund, I offer the same advice.?: invest your expenses through a strategic spending plan

what capital expenditure

capital expenditures invests in gold bullion or buying rental property.

Mainstream Americans generally can not engage in this kind of investment on a regular basis because you have to be debt free consumer before entering these markets.

I mean the kind of average Americans Investment expenses can afford to do this will help in the long run financially.

items acquired are not necessarily appreciate the assets, but they are the purchases that will help them repay consumer debt, build savings, provide for their families and the added value of the investment in time to family and relationships

I share my capital expenditure plan into three basic categories :.

- Debt Free Investments

- Savings Investments

- Lifestyle Investments

Debt Investments Free

When you get a refund check, unexpected insurance reimbursement, a performance bonus at work, a small inheritance, or if you have special military pay, it is important to consider purchases that will allow your overall financial situation.

debt free capital expenditure is using these funds to repay a portion of your consumer debt.

If you can pay your balances of credit cards, the amount you would normally send to this map could now be redirected to the next credit card you want to pay off doubling as (or triple) on your monthly minimum balances.

A snowball effect takes place and the ability to reduce consumption gains of debt launched the ultimate goal of becoming completely free of credit card debt.

The same principle is applicable to repayment of student loan debt or pay off a car loan early.

This "snowball effect" is one of the ways our family paid off 40K in consumer debt in just 2.5 years of a military man income .

a second type of debt-free investment spending implies to put the money to purchase an item you can normally buy on a credit card .

For example, if you have a student goes to college, they will need a laptop.

Or you can have a new baby and you really want to invest in a digital video camera, something you might normally put on a credit card.

other elements that fall into this category are the tires that will be replaced in the next six to twelve months- use unexpected funds for these necessary elements and keep you from accumulating new debt and move on forward financially.

Savings Investments

This part of the capital expenditure plan includes two areas.

first step is to using part of the repayment of funds to support regular savings account .

Each family should have 6-12 months of living expenses in a savings account that they can access easily. Share this review

This is a good opportunity to build this account.

The second aspect of this type of capital expenditure involved items you have saved to buy and the money for them is already in your regular savings account.

for example, you need a new refrigerator, stove and washing machine and dryer because you move to a new home that does not understand them.

Or, your old appliances wear out and require frequent service calls remain functional.

Another example is when you are saving for your annual property taxes and this money is also in the savings account.

When you get a refund check instead of taking money from savings, keep it in your savings account where the funds can develop and use the refund check to pay for those -ci items.

Some people set aside money in savings for new bicycles for children, baby items for a new baby in the family, or even a family holiday.

pay cash instead and do not deplete the savings account!

Lifestyle Investments

The last category is moderate to large purchase that the family is ready to buy in order to provide quality of life for your entertainment or leisure lifestyle.

For example, buying beautiful patio furniture or swings is a lifestyle investment because you provide effective means for your family and friends to have fun in your backyard.

I remember when we bought a set of quality game when our children were small. Although the initial investment was a bit much for our budget, we were able to get more value for our money in terms of number of hours that our kids had to play outside.

Not only the purchase keep our kids active and healthy, but my mental health have also benefited from investments that children worked their energy near the house.

Other examples in this category include the big screen for the family that decides to invest their dollars home entertainment instead of paying $ 60 for a family of four to go to the cinema TVs and popcorn.

These families choose to make a life choice by changing the temporary enjoyment of a movie theater for more permanent investment of a home entertainment system.

No matter how you choose to manage your manna, keep in mind that you can develop a strategic capital investment plan to use this money wisely.

I have never regretted paying our consumer debt, pay cash for our snow tires, buying playsets when our children were small, big screen TV when they became teenagers or laptops when they went to college.

When you invest in your family, there never regret! Share

What will your plan tailored investment expenses include

Photo Credit :? StockMonkeys.com via photopin cc

0 Komentar