The fiscal year 2014 brings new changes, thanks to the affordable care Act or ACA.

you may need to answer more questions as you prepare your return, and you may have to pay more, or less aÌ, tax aÌ based on the provisions of the ACA.

Here, AOS how the ACA may affect your 2014 income statement, depending on your situation:

insurance coverage through your employer

If you get health insurance through your employer, you may be one of the lucky ones who are wondering what all the fuss is about. You can receive the new IRS Form 1095-B, the reports of your insurance coverage, and 1095-C form from your employer.

Some employees may not receive these forms for the tax year 2014. If That, AOS case, gift, AOT worry.

Just answer the questions of TaxACT you prepare your return.

Other insurance coverage disease not on an exchange

If you pay for your own cover ACA-compliant insurance, or if you are on a program sponsored by the government such Medicare or Medicaid, you, get Äôll 1095-B form in the mail and enter the information in TaxACT.

No Health Insurance

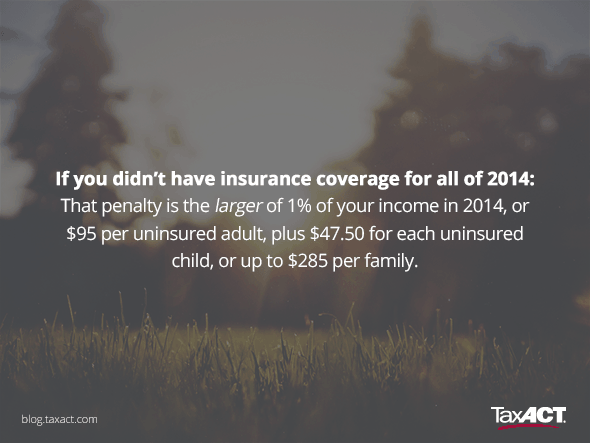

If you didn, AOT have insurance coverage for the whole of 2014, you may have to pay a penalty unless you meet an exception.

The amount will be calculated on your tax return, and it can reduce your refund or result in a tax bill.

This penalty is the greater of 1% of household income in 2014, or $ 95 per uninsured adults, plus $ 47.50 for every uninsured child, or up to $ 285 per family .

Few people actually have to pay the penalty this year, however.

insurance coverageFirst, you only need nine months of the year to be considered covered. Then there is a long list of other exceptions.

If your income is too low, so the less coverage you could find would cost more than 8% of your household income, if you Aore in prison or not legally in the United States, or you ask a number of challenges

If That, AOS is not enough, there, AOS a catchall exception :.

you don, AOT to pay the penalty if your plan was canceled and you believe the market plans are unaffordable, or if you experience any difficulty in obtaining health insurance.

Claim an exemption from the penalty ISN, AOT as simple as checking a box, however.

To claim an exemption, you must have the form 8965.

For some exemptions such as exemption on religious, you must apply the exemption by an exchange federal or state. For other exemptions, as having coverage only nine or 10 months of the year, you can prepare your 8965 form.

Health insurance in a market

Here, AOS where the ACA is more likely to affect your income statement in 2014.

If you have signed for health insurance market by a government-sponsored, also known as an exchange, you receive premium tax credits to help pay for your coverage.

the size of the grant was based on the income you said that you would have in 2014.

Unless you have a very predictable income, you have probably done more or less money than you expected.

This can result in a tax liability if you made more money than you intended and must repay part or all of your tax credit premium, or credit tax if you made less. Your refund of tax credit on premiums or additional tax credits are reported on IRS Form 8962.

If you have purchased health insurance through an exchange, you should receive Form 1095-A in e-mail with the information you need to prepare your tax return.

to complete the IRS Form 8962, you, need Äôll 1095 A.This-form information form is also sent to the IRS.

TaxACT reconciles all credit (with the tax on premiums Advanced Credit) you received in advance with your actual income based on answers to simple questions on income and insurance market. You might have some of the pain of return or be issued a larger refund.

0 Komentar